CapitaLand–UOL’s S$1.5 Billion Hougang Central Bid Signals Next Price Benchmark for OCR Homes

-

CapitaLand and UOL led the top bid of S$1.5 billion for the Hougang Central mixed-use site.

-

The land rate came in at S$1,179 psf ppr, well above expectations of S$800–S$1,000 psf ppr.

-

Analysts expect new homes to be priced around S$2,500 to S$2,600 psf, with upside potential.

-

The project will include 835 residential units and over 430,000 sq ft of commercial space, integrated with Hougang MRT and a bus interchange.

-

This will be Hougang’s first new private residential launch since The Florence Residences in 2019.

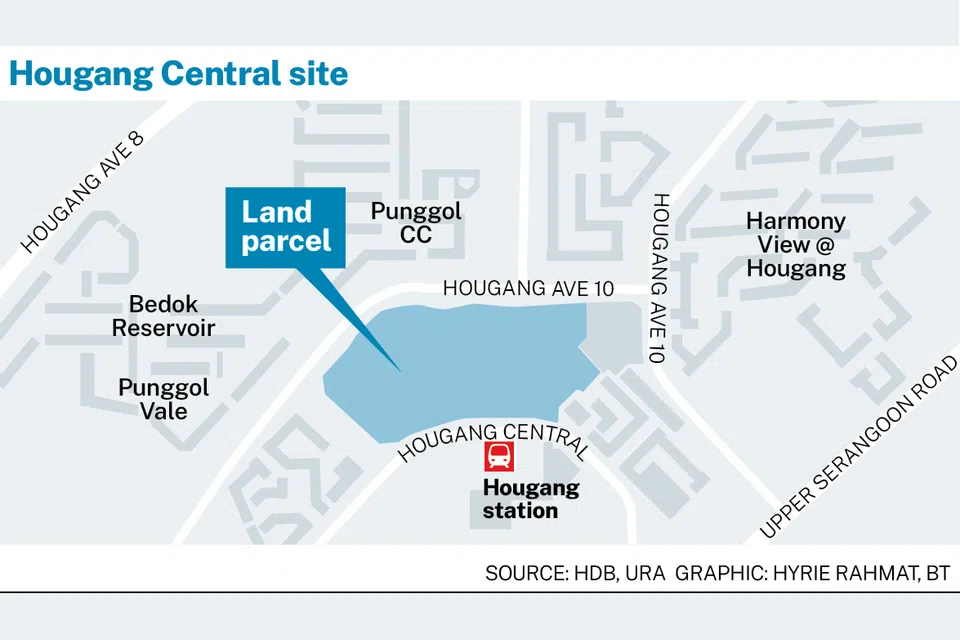

The tender for a major mixed-use site in Hougang Central closed on Dec 16 with three bids, led by a joint venture between CapitaLand and UOL group companies. Their top offer of S$1.5 billion, translating to S$1,179 per square foot per plot ratio (psf ppr), exceeded market expectations and set a new benchmark for large integrated developments in the Outside Central Region (OCR).

The 4.7-hectare site is slated for an integrated development featuring 835 residential units and more than 430,000 square feet of commercial space, nearly double the size of Hougang Mall. Part of the project will be built directly above Hougang MRT station and integrated with a bus interchange, making it one of the most transit-connected residential launches in the north-east region.

Strong Land Bid Above Market Expectations

Prior to the tender, analysts had expected bids in the range of S$800 to S$1,000 psf ppr. The winning bid exceeded this range comfortably, reflecting developers’ confidence in large-scale, transport-linked projects with retail components.

The top bid was submitted by Horizon Residential, comprising CapitaLand Development, UOL, Singapore Land and Kheng Leong, together with Horizon Commercial, a vehicle under CapitaLand Integrated Commercial Trust (CICT). The bid was around 2 percent higher than the second-placed offer from Sim Lian Group.

Hougang Central GLS Tender Results

| Bidder | Total Bid Price (S$) | Land Rate (psf ppr) |

|---|---|---|

| CapitaLand–UOL Consortium | 1.50 billion | 1,179 |

| Sim Lian Group | 1.47 billion | 1,155 |

| Frasers Property–led Consortium | 1.40 billion | 1,101 |

Expected Launch Prices and Market Context

Based on the land rate of S$1,179 psf ppr, analysts expect the new homes to be launched at around S$2,500 to S$2,600 psf, with the possibility of higher average selling prices due to the project’s scale, amenities, and transport integration.

For context, caveats data shows that over the past year:

-

The median price of new non-landed private homes in Hougang was S$2,075 psf.

-

The median price of resale private homes stood at S$1,539 psf.

This suggests a clear pricing gap between upcoming integrated developments and existing private housing stock in the area.

Comparison With Parktown Residence in Tampines

The same group had earlier clinched another large mixed-use site in Tampines in 2023 for S$1.21 billion, or S$885 psf ppr. That project, Parktown Residence, launched in February 2025 and sold over 87 percent of its units during its launch weekend at an average price of S$2,360 psf.

The higher land rate at Hougang Central points to a new OCR pricing tier, particularly for projects with direct MRT integration and large retail components.

Why Developers Are Still Willing to Bid Big

Despite the project’s size and complexity, market watchers were not surprised by the three bids received. Large GLS sites with land prices above S$1 billion typically attract fewer bidders due to balance sheet and execution requirements.

Industry leaders noted that Hougang has close to 60,000 dwelling units, providing a deep pool of HDB upgraders. Recent resale prices for four- and five-room HDB flats under 20 years old have reached median levels of S$675,000 and S$830,000, supporting affordability for private home upgrades.

Developers also see long-term value in integrated developments, especially when future supply of similar sites remains limited. The GLS programme for the first half of 2026 includes only one integrated site with a commercial component.

What This Means for Buyers

For homebuyers, this land bid reinforces a few clear signals:

-

Integrated MRT developments in OCR locations are moving into a higher pricing band.

-

Future launches in mature estates are unlikely to be priced below today’s benchmarks.

-

Buyers considering large-scale, transport-linked projects may see fewer comparable options in the near term.

With Hougang’s last major private residential launch being The Florence Residences in 2019, demand for a new, centrally located development is expected to be strong once sales begin.

Price Comparison: Hougang Central vs Nearby Benchmarks

| Project / Market Reference | Location | Project Type | Price (psf) | Notes |

|---|---|---|---|---|

| Hougang Central (Upcoming) | Hougang Central | New Launch (Integrated) | 2,500 – 2,600 | Analysts’ expected launch pricing based on S$1,179 psf ppr land rate |

| Parktown Residence | Tampines | New Launch (Integrated) | 2,360 | Average selling price; over 87% sold during launch weekend |

| Hougang New Private Homes (Median) | Hougang | New Non-Landed | 2,075 | Median price over the past year (excluding ECs) |

| Hougang Resale Private Homes (Median) | Hougang | Resale | 1,539 | Median resale price over the past year |